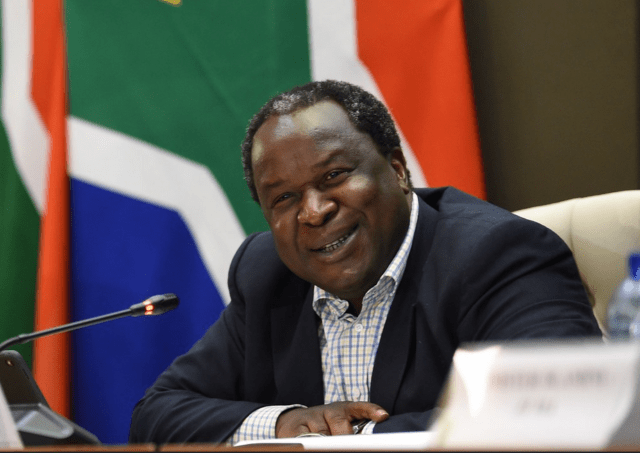

Finance minister Tito Mboweni says that South Africa’s second-quarter contraction in gross domestic product (GDP) is larger than expected by both the National Treasury and the Reserve Bank, which raises the risk that the GDP outcome for 2020 could be worse than previously thought.

Mboweni said in an opinion piece for the Sunday Times, that the coronavirus pandemic has left government finances ‘dangerously overstretched’ while heightened debt threatens the country’s future economic prospects.

“The reduction in economic activity in the second quarter has flowed through to lower tax revenue, especially in the main tax instruments of personal income tax and VAT, exacerbating the precarious fiscal position,” he said.

The minister said that the economy is likely to contract by more than the 7% previously forecast by the Treasury.

Mboweni said that tax revenue is expected to fall by a greater proportion than the contraction in GDP – although this is by design.

“Businesses pay tax only on profits, and as wages fall, effective tax rates on income reduce. The tax system is inherently counter cyclical. Yet revenue outcomes will be lower still due to the emergency measures to provide tax relief and support to businesses and households during the crisis.

“There is still a risk that the weaker GDP figures will translate into further revenue shortfalls, though the vast majority of the reduction is already reflected in the estimates published in the supplementary budget in June.”

The finance minister said that the expected shortfall of more than R300 billion, around 6.2% of GDP, means the country will have to borrow more money.

“Failure to contain our ballooning debt and debt service costs, and narrow the budget deficit, will damage the long-term economic prospects.”

A warning

Ratings agency Moody’s meanwhile, said that the loss in government revenue will be much more severe than South Africa’s fall in economic activity.

In a research note on Thursday (10 September), Moody’s said that under-performing revenue has been a key credit challenge in the country for an extended period. At the same time, opposition from influential stakeholders including unions has constrained the authorities’ ability to contain spending in response, it said.

The ratings agency said that the revenue shortfall will further complicate the supplementary budget’s target debt stabilisation by 2023.

“The loss in revenue will be much more severe than the fall in economic activity. The smaller tax base stemming from lockdown measures, job losses and lower confidence accounts for the vast majority of the revenue shortfall,” it said.

“Tax-relief measures included in the government’s support package are a secondary driver of the revenue loss.”

Additional tax measures

The National Treasury plans to raise an additional R40 billion in tax increases over the next four years with additional measures, such as a proposed wealth tax, set to help with this collection.

A proposal document presented last week by Edgar Sishi, acting head of the budget office, to the National Economic Development and Labour Council (Nedlac) shows that this R40 billion will be made up of R5 billion in collections in 2021-22.

Treasury then plans to collect an additional R10 billion in 2022-23 and in 2023-24 each, and R15 billion in 2024-25.

The proposal document, which has been seen by Bloomberg, states that additional tax measures will be announced in February 2021, with research and analysis currently being focused on wealth taxes.

In July, Sishi said that Treasury was considering research reports from the Davis Tax Committee on the possible introduction of new measures, including the viability of a wealth tax and how it relates to a land tax and estate duty.

“We are looking at these recommendations. It is important to remember that tax amendments over the last five years have included some of these proposals and we are looking at additional proposals for the 2021 budget,” he said at the time.

Mboweni has also said that Treasury is discussing the possibility of an inheritance tax and a so-called solidarity tax in a bid to raise additional finances.

Taxes on the wealthy are favoured politically and a solidarity tax, associated with the virus outbreak, would be limited in duration. In South Africa’s top income-tax rate is 45%, corporate tax is 28% and VAT is 15%.

Read: Moody’s sends warning over South Africa’s shrinking tax base