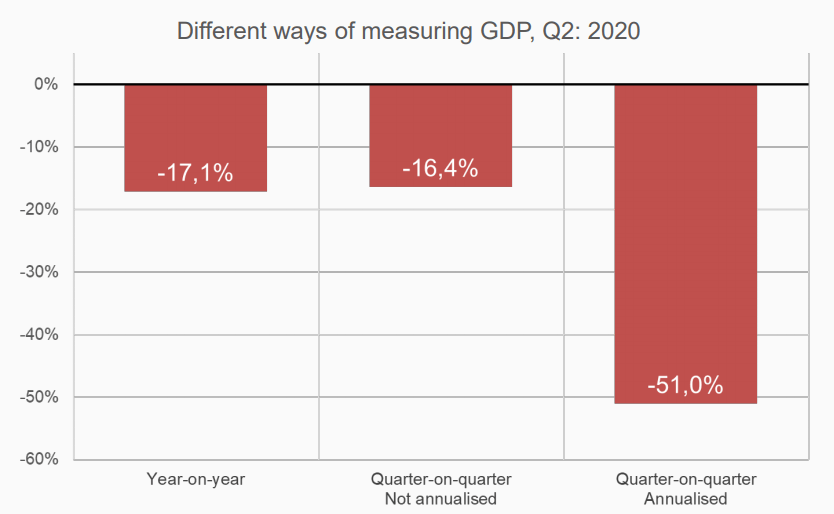

Economists and analysts have criticised Statistics South Africa (Stats SA) for headlining its second quarter gross domestic product (GDP) data with a 51% decline, saying it gives the impression that South Africa’s economic output halved over the last quarter – which it did not.

Stats SA on Tuesday (08 September), said that GDP in the second quarter of the year declined by 51% on a seasonally adjusted annualised basis.

While this figure is accurate, and is how the stats body has historically reported on GDP data, academics argue that it does not reflect the reality of the highly anomalous quarter.

“In a normal world, for most economic data, including GDP data, we like to have the data annualised. This is mainly because annualised data allows us to compare data that is collected over different periods of time. This is clearly the case for GDP data,” said Imraan Valodia Dean of the Faculty of Commerce, Law and Management at the University of the Witwatersrand.

“Ordinarily, from one quarter to the next, GDP data does not fluctuate dramatically, so the annualised data is a useful approach, and we can compare GDP growth rates in this annualised fashion.

“However, in instances where the quarterly data may fluctuate in a dramatic fashion, as has been the case with the Covid-19 and the lockdown, this calculation, to annualise the estimate, is highly misleading, because it assumes that the economic effects of a lockdown will continue as it did for the second quarter, for four consecutive quarters,” she said.

The decline seen in the second quarter is highly unlikely to continue, given that economies have now opened up – making the 51% figure not representative.

This has been echoed by several other economists and academics, including professor Philippe Burger, pro vice-chancellor: Poverty, Inequality and Economic Development at the University of the Free State.

“There should be a word of caution before we go off the rails – and it relates to how we understand the 51%. The economy in Q2 is not half its size in Q1,” he said.

“The 51% is an annualised rate, i.e. we take Q2 shrinkage and ask, ‘If the whole year looks like this, with how much will the economy shrink?’ Output in Q2 was 16.4% smaller than in Q1. That is bad as it is, but the whole year will not look like Q2 ‑ there will presumably be a rebound as we speak, in Q3 and Q4,” Burger said.

He said that economic shrinkage will likely come in under 10% in 2021.

“On a year-on-year basis, GDP in 2020Q2 is 17.2% smaller than in 2019Q2. But hopefully 2020Q4, on a year-on-year basis, will also come in under 10%. We therefore have a big recovery problem, but we need to nevertheless keep a sense of perspective: we did not wipe out half the economy.”

Deep recession

The commentators stressed that despite the ‘misrepresentation’ of the GDP reality by the 51% figure, it should not distract from the fact that the country is in a deep recession.

Even at a 16.4% quarterly decline, the impact of the lockdown on GDP in nominal terms has been severe, and it will take a long time for the country to recover from this position.

“An improvement in economic activity is expected from the shorter-term consequences of Covid-19, as the government eases lockdown regulations and restrictions. However, the longer-term consequences will take significantly more time and effort to redress,” said Ricardo Smith, investment strategist at Absa Global Investments & Solutions.

“National Treasury forecasts economic growth to be -7.3% in 2020, which would be the largest contraction in nearly 90 years. Bloomberg median expectations are broadly in line but slightly more pessimistic than Treasury’s. They see the domestic economy contracting by 8.0% in 2020, before recovering to register positive growth of 3.0% and 1.9% in 2021 and 2022 respectively.”

Sanisha Packirisamy, economist at Momentum Investments, said that the level of economic activity is only likely to return to pre-Covid-19 levels by 2023/24.

“GDP Numbers Misleading” is a mainly true headline rather like a ‘protestors largely peaceful’ headline. The contents, however, are a description of technical detail that provide no insight into as to recovery prospects, which are quite ‘challenging’. pic.twitter.com/qLLiWAjWPV

— Chris Hart (@chrishartZA) September 9, 2020

South Africa’s lockdown economic recovery, which many believed would be V-shaped, took off initially but then slowed down. “After the lockdown changes to the economy in the last recent months, this is to be expected. What we’re seeing also suggests a more subdued recovery for the economy in the months ahead,” said Mike Schüssler, chief economist at economists.co.za.

It is likely that we will see a strong bounce back in the GDP in Q3 2020, he said.However, the economy’s return to its previous levels will not be reached easily, especially as businesses now take on the extra pressure and costs brought by load shedding.

Added to these are the capacity and inflationary problems, as well as the potential reappearance of bureaucratic hurdles, the relaxation of repayment holidays and other temporary measures that were introduced as financial crutches during this period. Then there are the economic indicators, such as employment, which lag economic recovery by a few quarters, the economist pointed out.

The full recovery for the SA economy is still likely to be at least 18 months away, with some economists predicting that it could take up to four years to make a full recovery.

“Economists refer to what we’re experiencing as the ‘swoosh recovery’ as in the Nike logo. The decline was quick and the first part of the recovery was too. But after these, the tail is long. The recovery, however, is likely to continue but at a steadier and slower pace in the quarters to come. The closer to full recovery the economy gets, the slower the recovery process will be,” said Schüssler.

“It will take some time for the economy to return to the levels it was before lockdown.”

Read: It will take years to get South Africa’s economy back to pre-Covid levels: economists