South Africa’s banks face a difficult challenge in the short-to-medium term as they deal with the impact of Covid-19, a depressed local economy, and customers seeking debt relief.

Theses factors are likely to increase competition among the big five retail banking institutions moving forward.

BusinessTech has looked at the larget retail banks, measuring them across 10 key indicators – ranging from customer base to P/E ratio.

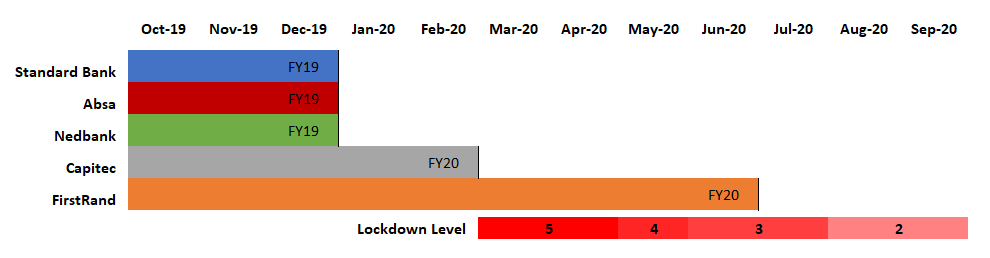

The data below covers group and South African data, as indicated, taken from each respective bank’s latest full year financial results.

Note: With the exception to FirstRand, whose full year results end mid-year 2020, most of the results below do not reflect outcomes or effect of the Covid-19 pandemic and lockdown.

The data covers:

Market capitalisation and P/E ratio (Group)

Three years ago, Capitec had the smallest market capitalisation across the big five retail banks – today, it has the third largest, above Nedbank and Absa on the Johannesburg Stock Exchange.

FirstRand meanwhile, has comfortably surpassed Standard Bank, and takes the top spot at R230 billion.

Capitec has made significant gains in its share price, and far outpaces any other of the competing banks, but also carries that highest price over earnings (P/E) ratio as a result.

The P/E ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

The ‘cheapest’ stock among the banks is now Nedbank, with a P/E of 6.27.

Data captured on 10 September 2020.

| Bank | Market Cap | Share price | P/E Ratio |

|---|---|---|---|

| FirstRand (FNB) | R230.0 billion | R41.89 | 8.06 |

| Standard Bank | R185.7 billion | R119.14 | 8.12 |

| Capitec | R111.2 billion | R986.78 | 17.72 |

| Absa Bank | R89.3 billion | R92.92 | 9.93 |

| Nedbank | R50.6 billion | R104.44 | 6.27 |

FY Financials (SA)

Standard Bank draws the highest net-interest income, and the highest headline earnings in South Africa. On a group level, Standard Bank and FirstRand are closely matched, with the former recording R62.92 billion vs the latter’s R62.85 billion.

However, because FirstRand’s financial year ended June 2020, it’s the only bank to reflect the impact of the Covid-19 pandemic and lockdown – which should give an indication of how the crisis will reflect on the annual results for the other banks, when reported.

Consumers have come under extreme pressure due to the Covid-19 lockdown, and have sought out various forms of financial aid offered by the banking groups. The pressures have also led to forward-looking impairments being factored into the financials.

For the purposes of the comparison below, we’ve used FirstRand’s results for its retail segment FNB only, before impairments related to Covid-19 are taken into account.

The financials for the banks reflect earnings within South Africa, not taken at a group level.

Headline earnings are a measurement of a company’s earnings based solely on operational and capital investment activities. It excludes income that may relate to staff reductions, sales of assets, or accounting write-downs.

| Bank | Net Income (SA) | Headline Earnings (SA) |

|---|---|---|

| Standard Bank South Africa | R41.6 billion | R16.6 billion |

| FirstRand (FNB) | R37.8 billion | R12.3 billion |

| Absa Bank Ltd | R31.8 billion | R7.3 billion |

| Nedbank Ltd | R27.4 billion | R10.4 billion |

| Capitec | R16.6 billion | R6.3 billion |

Core Capital (Group)

The Banker’s top 1000 banks report is based on a measure of a bank’s Tier 1 Capital – known as core capital, which consists of shareholders’ equity and retained earnings.

Standard Bank has maintained its position as the country’s biggest bank, recording $10.54 billion in tier 1 capital in 2020.

This is followed by FirstRand, which is closing the gap with the country’s leader.

Absa follows in third, with Nedbank retaining its fourth position. Capitec was not ranked among the top 1000 banks in 2020, but reported Tier 1 capital at $1.36 billion.

| Bank | Tier 1 Capital |

|---|---|

| Standard Bank | $10.55 billion |

| FirstRand (FNB) | $9.16 billion |

| Absa Bank | $7.77 billion |

| Nedbank | $5.71 billion |

| Capitec | $1.36 billion |

Network and reach (SA/Group)

With news of the legacy banks scaling down their bricks and mortar networks, it’s no surprise to see a reduction in overall branch numbers across the banks. However, following the trend seen in 2019, Capitec has increased its reach again, now at 864 branches and 5,652 ATMs.

Standard Bank still has the biggest branch network and the second biggest ATM network. Absa has 1,016 branches across its group operations, and 9,763 ATMs, giving it the widest network by that measure.

When counting group employees, Standard Bank is the biggest employer (50,691 versus FirstRand’s 49,233), however on a local scale it leads Nedbank and Absa by a much smaller gap. FirstRand does not specify how many people are employed by FNB.

| Bank | Employees (SA) | Branches (group) | ATMs (group) |

|---|---|---|---|

| Standard Bank | 29 578 | 1 114 | 8 970 |

| Absa Bank | 28 296 | 1 016 | 9 763 |

| FirstRand (FNB) | Not stated | 604 | 5 622 |

| Nedbank | 29 213 | 692 | 4 398 |

| Capitec | 14 590 | 864 | 5 652 |

Banking customers (Latest Reported)

Absa has updated its customer base in its 2020 interim results, revealing a base of 9.7 million customers. This was the same number declared in the bank’s FY 2019 results.

As of June 2020, this includes only 6.7 million transactional accounts, with a primary base of 2.9 million customers.

This places Absa second among the big five banks, behind Capitec, which still leads the pack, reporting 13.9 million customers at the end of February 2020. Chief executive, Gerrie Fourie, has since stated the figure is at 14.5 million at August 2020.

At FY 2019, Standard Bank reported a total of 9.6 million customers, including 8 million active clients, and 1.6 million unique instant money customers, placing third overall. In its 2020 interims, it reported a combined base of 9.1 million active customers.

Nedbank reported 7.5 million retail clients at the end of 2019, with the group’s latest interims pegging the number at 7.3 million. FirstRand’s latest results put FNB’s customer base at 8.2 million, with retail customers accounting for 7.2 million.

The group has seen small declines in its middle market account base, but this has been offset by growth in its premium segment.

While customer numbers are important, keeping clients happy is also a key factor. According to the South African Customer Satisfaction Index (SAcsi) on banking for 2019/20, Capitec is again top out of the big five.

This is followed by Nedbank, FNB, Absa and Standard Bank.

| Bank | Active retail customers (Latest reported) | Customer Satisfaction (2019.20) |

|---|---|---|

| Capitec | 14.5 million | 84.0 |

| Absa Bank | 9.7 million | 76.8 |

| Standard Bank | 9.2 million | 75.3 |

| FirstRand (FNB) | 8.2 million | 79.9 |

| Nedbank | 7.3 million | 80.2 |