The South African Local Government Association (SALGA) is considering a number of new measures to improve municipal revenue collection across the country.

SALGA president Thembi Nkadimeng said that this will include working with the South African Revenue Services (SARS) and possibly withholding refunds for non-payment.

“(One of the measures includes) amending the Tax Administration Act so that before SARS pays tax refunds, they first check if the particular taxpayer does not have monies due to his/her municipality,” she said.

“If the taxpayer owes, the amount due to the municipality will be paid first before a refund is deposited to the tax pay account.”

Nkadimeng said that data from the country’s auditor-general shows a clear decline in local government collections.

“Municipal audit outcomes confirms that the financial statements show increasing indicators of a collapse in local government finances. The auditor-general further confirms that the financial woes of local government also weighed heavily on municipal creditors,” she said.

“As it relates to debts owed to municipalities it is a well-known fact that an average of 59% of municipal debtors are not recoverable; in 55 municipalities more than 80% cannot be recovered; and debt collection at 99 municipalities was more than 90 days.”

Nkadimeng said that other measures which are being considered include:

- Write-offs – This will include putting together measures to write-off the ever-increasing household debts to municipalities, including the introduction of a national bill for the writing off of these household debts in exchange for the installation of prepaid water and electricity metres.

- State employees – Amending schedule 2 section 10 of the Municipal System Act so that it is not only municipal councillors and employees who may not be in arrears with their municipal bills for a period more than three months. This requirement should be extended to all state employees and elected and appointed representatives in other spheres.

- New agency – The establishment of a District Revenue Collection Agency. This will achieve better collection efficiencies and will free up municipal personnel to focus on more pressing service deliver efforts. SARS systems and processes would be considered in putting this together after due diligence is done.

- Procurement changes – Amending the procurement regulations to make it compulsory for any potential service provider to produce a municipal services rates compliance certificate, prior to being awarded a government contract.

- Resolve municipal debts to Eskom – Nkadimeng said that the municipal debt to Eskom continues to rise without any improvement, the debt owed to municipalities by customers including organs of state is also still rising sharply, and this will worsen under the current Covid-19 impact.

Fixing municipalities

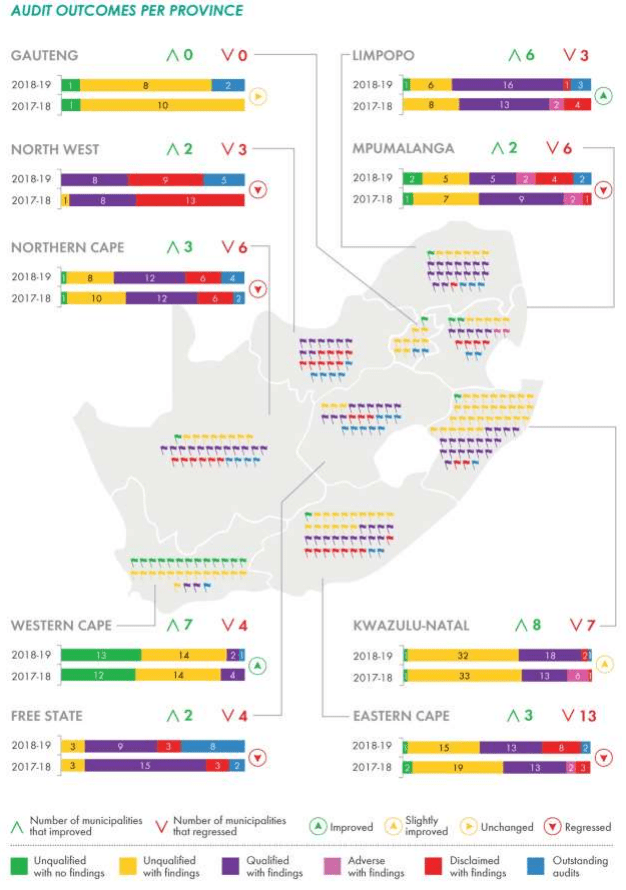

Data from the local government audit outcomes for 2018-2019 shows that there was again a regression in the audit outcomes under the current local government administration, now in its third year.

Over the three-year period, the audit outcomes of 76 municipalities regressed, while only 31 improved. Only 11% of the 257 municipalities getting clean audits.

Auditor-General Kimi Makwetu said in a conference on Tuesday (8 September) that before South Africa moves to its planned District Development Model (DDM), the country should bring together preventative controls to improve the financial state of municipalities.

“In most instances, when municipalities receive funds, it is seldom that you find proper project plans being developed at a municipal level,” he said. He added that ‘prevention is so much better than healing’, because it saves the labour of being sick.

“Government stakeholders should be asking themselves if they are putting in place all the necessary administrative support functions to help local government achieve its objectives.”

The state of the country’s finances will be particularly important as the government prepares for the roll-out of its new district model.

In a presentation on Tuesday (8 September), Minister of Cooperative Governance and Traditional Affairs (Cogta) Nkosazana Dlamini-Zuma said that over the past 20 years, local government has not adequately fulfilled its role, especially as it relates to economic development.

She added that the ‘pedestrian growth’ which the country has registered over the past decade was ‘simply not enough’ to ensure employment and income for a majority of people.

To address these and facilitate for better coordination and integration, government has adopted the new District Development Model (DDM).

“The DDM seeks to strengthen the local sphere of governance, moving us away from silo planning, budgeting and implementation,” she said.

Dlamini-Zuma said that the new model will provide for a ‘more tangible, common vision for development’ of the country. She said that government further plans to locate each district’s competitive advantage and ‘utilise it for shared growth and prosperity’.