There are more than 5,000 cryptocurrencies in existence today.

While Bitcoin is the oldest and most well-known cryptocurrency, an ecosystem of developers, traders, investors, miners, and entrepreneurs have entered the crypto space.

They’ve created thousands of new cryptocurrencies. Some compete with Bitcoin while others do something completely different.

As an analogy, think of apps like WhatsApp, Facebook Messenger, Twitter, Snapscan, Instagram, and Uber.

While they’re all apps, some are in competition, while others serve a completely different function. This spectrum exists in crypto too.

Some cryptocurrencies aim to offer cash-like anonymity, while others aim to tackle a specific industry like supply chain management, cloud computing, file sharing, advertising, the list goes on.

Bitcoin has opened a Pandora’s box with all the new crypto assets that have emerged. Now that the box is open, there’s no going back and as cliche as it sounds – the future has arrived.

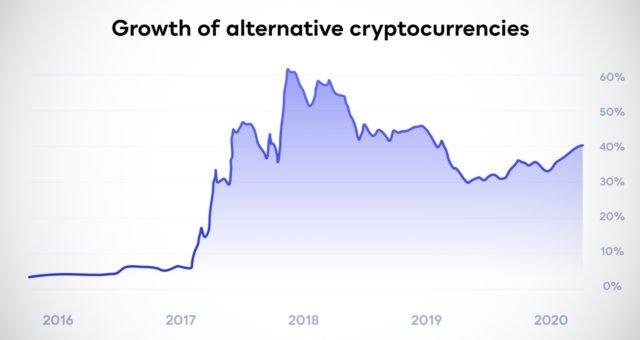

Over time these cryptocurrencies have been challenging Bitcoin’s market capitalisation.

Bitcoin’s dominance, which is how valuable Bitcoin is relative to the rest of the cryptocurrency market, has dropped to 61% from 90% just 6-years ago.

Meanwhile, the cryptocurrency market has grown over 47 times over the same time period, to today’s $330Bn value.

What does it mean for us as investors?

It means there may be multiple success stories in the crypto space. On the other hand, it also means there’s a possibility that a cryptocurrency that looks good today is really the equivalent of MySpace – soon to be overtaken by Facebook.

Picking long-term winners is challenging

If all these cryptocurrencies have different use cases and performance, why not just invest in the best few names?

Sean Sanders, the CEO and founder of JSE backed investment platform Revix explained that “It’s almost impossible to predict which cryptocurrencies will be the success stories of tomorrow.”

“In January 2015, Bitcoin had a market cap near $4 billion and Ethereum hadn’t even launched yet. If you’d asked anyone in the crypto space whether they thought Ethereum would be worth 4 times Bitcoin’s current market cap in just 2 years, they would have laughed at you. But that’s exactly what happened.”

This year Ethereum is up over 2 times versus Bitcoin’s returns. Sanders continued “It’s not that Ethereum is the new best crypto to own. The point is that, while it’s easy to identify the current winners, it’s hard to predict the future.”

So what cryptocurrencies will be the top performers next week? In three years time, how many crypto winners will there be?

Sanders explained “No one knows. And fortunately, you don’t have to as our Bundles aim to deliver on one promise: to make sure that customers own the top cryptocurrencies, whatever they may be.”

How do I invest?

Picking one cryptocurrency to back – even if it is Bitcoin – can be risky because, regardless of your best analysis, you may have picked the wrong horse to back.

Even the professionals only get it right half the time. Many professional investors prefer a diversified approach, so you’re ‘not putting all your eggs in one basket’.

Instead, you’re buying a basket of cryptocurrencies.

Sanders continued “Crypto investing can be complicated, time-consuming and downright intimidating, so we created an ultra-simple investment platform that enables you to own a diversified Bundle of the top cryptocurrencies for as little as R500. And what’s great is that you can sell out of your Bundle and withdraw your funds at any time.”

Revix’s Bundles are ready-made investments that provide you with direct exposure to the underlying cryptocurrencies within each Bundle.

This means that you don’t have to guess which cryptocurrencies to own. Investing is as easy as signing up and buying a Bundle.

The most sought after component of Revix’s Bundles is their ‘invest and leave it’ functionality. Their Crypto Bundles automatically update your holdings every month so that you always stay up to date with the fast-paced crypto market.

“Our crypto Bundles let the most successful cryptocurrencies come to you and this puts your whole investing experience on autopilot – making your money work harder for you” explained Sanders.

Revix offers 3 crypto Bundles on its platform, all of which have out performed Bitcoin since the start of 2020.

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top 5 payment focused cryptocurrencies looking to make payments cheaper, faster and more global.

These cryptos include the likes of Bitcoin, Ripple, Bitcoin Cash, Stellar and Litecoin.

The Smart Contract Bundle provides equally weighted exposure to the top 5 smart contract focused cryptocurrencies like Ethereum, EOS or Tron that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its OS operating system.

What else does Revix offer?

In addition to Revix’s Crypto Bundles, they offer:

Bitcoin: The largest and most well-known cryptocurrency,

Paxos Gold: A regulated token that is backeD 1:1 by physical gold held in fully insured London Brinks vaults, and

USDC: A US dollar stablecoin called that is backed 1:1: by US Dollars

What fees does Revix charge?

Revix doesn’t charge monthly subscription fees, but rather a simple 1% transaction fee for both buys and sells and a 0.17% per month rebalancing fee (which amounts to 2.04% a year only) on the total Bundle value held.

So whether you want to invest in a slice of the entire crypto market or a specific niche sector in the crypto space, Revix has a low-cost and easy to use investment option to suit your needs.

About Revix

Revix brings simplicity, trust and great customer service to investing. Their easy to use online platform enables anyone to securely own the world’s top crypto assets in just a few clicks.

Revix guides new clients through the sign-up process, to their first deposit and first investment. Once set up, most customers manage their own portfolio, but can access support from the Revix team at any time.

For more information, please visit revix.com

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose and before investing, please take into consideration your level of experience, investment objectives, and seek independent financial advice if necessary.

This article was published in partnership with Revix.