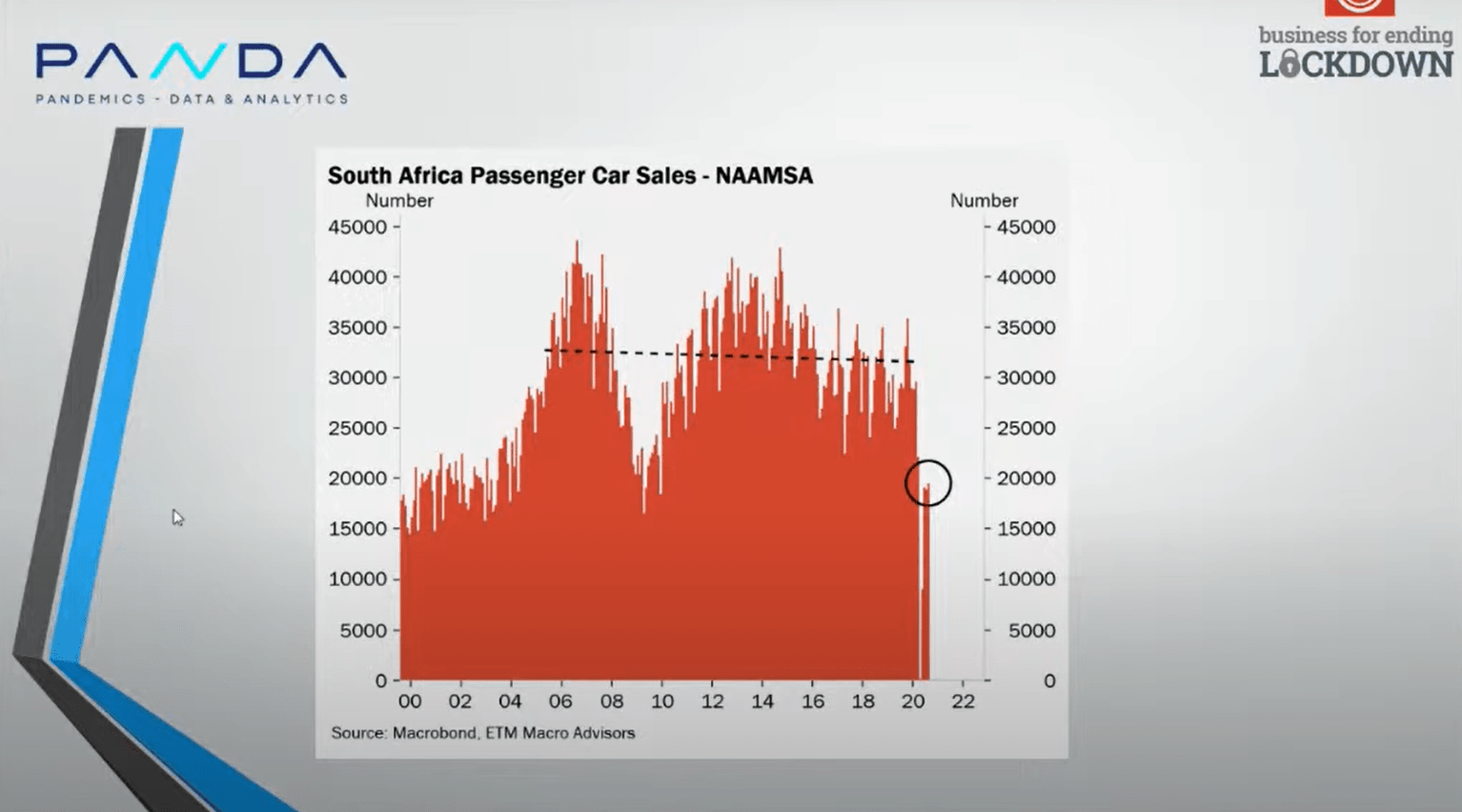

The sale of South Africa’s passenger vehicles is a good barometer of economic activity, with the latest data pointing to a weaker post-lockdown recovery than expected, says Russell Lamberti founder of investment advisory firm ETM Macro Advisors and member of Panda.

In a presentation for business group Sakeliga, Lamberti said that data from National Association of Automobile Manufacturers of South Africa (Naamsa) shows that South Africa was selling around 30,000 passenger cars per month.

Subsequently, vehicle sales were almost non-existent in April as South Africa underwent the strictest part of its lockdown. “We would naturally expect to see a quick bounce from that, and we do indeed see that,” Lamberti said.

However, he noted that while there has been a recovery seen in May and June, it appears that the sales are already starting to stagnate to levels well below those seen prior to the lockdown.

“Worryingly, since June we have actually seen sales start to stabilise at around the 20,000 units per month mark – whereas you would have hoped and expected a stronger recovery back to the 30,000 level after lockdown.”

Lamberti said that vehicle sale are a useful barometer for consumer credit health, household finance as well as consumer confidence. He added that this trend is particularly concerning as interest rates have been ‘slashed’ by the Reserve Bank over the last few months.

“So for car sales to have only recovered to around two-thirds of their prior volume, with such low-interest rates, tells you about the pain that is still being endured in this market and I think that is really something that we need to be concerned about.”

In an analysis of the recent Naamsa data, Nedbank said that the underlying trend remains ‘lacklustre’ as the move to a level 2 lockdown in the third week of August should have somewhat contributed to the normalisation of activity in the new vehicle market.

“The rebound in vehicle sales will be constrained by a weak economy, with the boost from lower interest rates dampened by weak consumer incomes and corporate earnings,” it said. The group said it now expects a real GDP contraction of 8.1% and growth of only 2.7% in 2021.

“Power supply disruptions, with load shedding set to continue until at least end-2021, will also be a drag on the recovery. Activity in the rental market will remain depressed for as long as global travel restrictions in place and compromised household incomes and confidence deter tourism.”

It said that South African exports will benefit from the expected faster recoveries in key markets, Europe and Asia, but the boost from global demand will be moderate.

[embedded content]The National Automobile Dealers’ Association (NADA) said that there was an expectation in the minds of most new vehicle dealers in South Africa that there would be an improvement in the sales rate, as the country moved to level 2 lockdown rules, with opportunities for increased social involvement.

This did not occur, and the recently released new vehicle sales figures for August show a market that remains fairly stagnant, the group said.

“We don’t anticipate that we will see any marked recovery any time soon. This is probably our new normal for a while,” said Mark Dommisse, chairperson of NADA.

Dommisse said that many of potential buyers, be they businesses or members of the public, remain under massive financial pressure while also facing the unknown in terms of future business and employment prospects. Relatively few are in a position to commit to vehicle repayments over increasingly longer periods, he said.

“We trust that the SA Reserve Bank keeps interest rates low for an extended period of a least two years to enable markets to recover. This could form one of the major building blocks for the government as they look to stimulate the economy.

“Inflation remains low, but there are noticeable increases in household expenses and fuel costs, all of which will have an inflationary impact in the short to medium term.”

Read: South Africa’s economic environment is changing how people finance their cars